Budgeting Tips & Money Matters

Washington, DC is one of the most expensive areas in the United States. Your immigration document has outlined the most basic costs required to live in the nation’s capital. Because lifestyles vary across people and cultures, we encourage developing a budget prior to arrival that fits your lifestyle as well as your financial means. It is important to acknowledge that it is extremely difficult to secure any additional funding once you arrive in the United States.

To help plan and budget for your expenses, the Georgetown Office of Student Financial Aid offers a program called Common$ense.

We suggest visiting Georgetown’s Neighborhood Life website to access their budget sheet and other resources to understand the full anticipated cost of living and studying at Georgetown.

F-1 students experiencing unexpected financial difficulties due to circumstances beyond their control or due to emergent crises, such as war or natural disaster, in certain countries or regions may be eligible for special employment authorization.

Financial Glossary

Security Deposits

The concept of a security deposit is common in U.S. culture. Requests for security deposits are generally encountered when leasing a house or apartment (the deposit is generally returned at the end of the lease term), but can also be required when signing up for utility services, or when renting a vehicle from a rental car company.

Rental companies and landlords will typically ask for a security deposit that equals one month’s rent, which you give to your rental company landlord in addition to your first month’s rent. Your security deposit is used to pay for any damages which might occur during your occupancy, to pay for cleaning/repairs when you move out, if you do not leave your apartment or house in satisfactory condition, or to hold if you do not pay your rent. You should receive your deposit back when vacating your residence if you have fulfilled all the requirements in your lease. You will generally not receive your security deposit back if you break your housing lease or damage the residence in any way.

Utility companies will generally ask for a deposit of $50-$100. When you sign up for utilities, ask how the deposit is used.

Rental car companies will also ask for a deposit of $200-500. Your security deposit is used to pay for any damages or accidents that may occur during the rental period. They may also keep the deposit if you do not add gas before returning the car, or if the car is not cleaned satisfactorily to the company’s standard. If the car is returned according to all requirements, the company should return your deposit or release the hold on your credit or debit card.

Bank Accounts

There are many banks and companies that offer low rate credit cards to international visitors who do not have any established credit in the U.S. While OGS does not endorse any particular bank or company that provides credit card services, a good way to start your research on which card is best for your needs would be to check the banks that operate close to campus. Please see the Banking Information Handout (PDF) for more information.

PNC Bank is Georgetown University’s campus banking partner and we recommend you take a look at what they offer at pnc.com/georgetown and review their flyer (PDF).

Credit Cards

You’ll find most Americans rely on their credit card or debit card to make purchases, even more than cash. While there are times when you will need to pay in cash (for example, paying for a drink at a small bar or buying a hotdog from a food truck), you will see that most merchants in American cities are set up with the infrastructure for card, contactless and mobile payments. Visa, Mastercard, and American Express are widely accepted. ATM and currency conversion fees may apply. There are only a couple of travel-friendly debit accounts currently offered on the US market. Investing in a credit card, and paying the balance in full each month, is a great way to establish a strong credit history in the U.S. and show others that you are able to repay debts.

Establishing Credit

In the United States, every person’s credit history is linked to their Social Security number (SSN). Credit history reveals your patterns of taking loans or credit, paying them on time, how many times you make a late payment, and whether you have defaulted on a loan. Without a credit history, you may encounter difficulty getting a loan, renting an apartment, getting a cell phone or a credit card. Bad marks on your credit (late payments and no payments) usually last seven years. You may receive credit card offers in the mail. That does not mean you are automatically approved for the credit card. Students and scholars without income may have trouble getting approved for a credit card. Some companies require that you live in the United States for six months to be eligible to apply for a credit card. Having a checking account or savings account can also help build a credit history. Having a lease, telephone service or other utilities in your name will also establish a credit history.

For more general information on how to establish credit, please visit the Georgetown University Alumni and Student Federal Credit Union (GUAFSCU). GUAFSCU has favorable interest rates and is a credit union that is exclusively offered to Georgetown students and alumni. GUAFSCU also has a blog page with articles to help the Georgetown community learn more about Financial Wellness.

State and Federal Taxes

U.S. law requires all individuals living in the United States to submit tax forms to the Internal Revenue Service (IRS). Each year the U.S. Government establishes a threshold for taxation and any income earned above that threshold may be subject. This means that a University stipend or scholarship may be taxed, and the entire amount of the stipend will not be available for daily living expenses. Please do not be alarmed if you received a scholarship or stipend from the University, but do not receive the full amount. This may mean that the amount differential has been reserved for your tax payment. Check with the University tax office if you are concerned.

Individuals earning income in the United States may be required to submit a tax return and pay a portion of their income in taxes to the U.S. Government. Often, these taxes are taken out of each paycheck and reduce the total compensation that individuals receive from an employer or scholarship provider. The University will provide software and information sessions each spring to help international visitors understand their tax obligations. Students who are paid by Georgetown University, whether through tuition scholarships, assistantships or hourly work and scholars who receive payment through Georgetown will be sent tax documentation from the University tax office. More information will be provided from our office in February, when the tax season officially begins.

For more information on U.S. taxes and international students, see the OGS Taxes web page.

Tipping

It is not only customary but expected that individuals will tip for service in America. Tips are generally given to waiters and waitresses in restaurants, bar tenders in restaurants, clubs and bars, taxi drivers and individuals who work in barber shops and beauty salons. Tips are not only recognition of good service, but part of the compensation to those who perform good service. The tip is generally not included in a bill, except in restaurants for larger groups. A tip is normally calculated between 15% and 20% of the bill (before tax is added). Taxi drivers, however, usually receive 10% of the fare.

Peer-to-Peer Payment

It is customary for Americans to share the costs of meals and entertainment when they go out together. You will find that many students use peer-to-peer payment smartphone apps to easily split the cost with friends, pay people back, and request money without having to use a credit card or carry cash.

Venmo, Square Cash and Paypal are examples of companies that provide peer-to-peer payment service apps. Once you download a peer-to-peer payment service app to your smartphone, you are able to link your app account to a funding source, like a credit card or bank account. If your friend or classmate has an account with one of these apps, it will allow you to easily transfer funds to their account, and for your friends to transfer money to you as well.

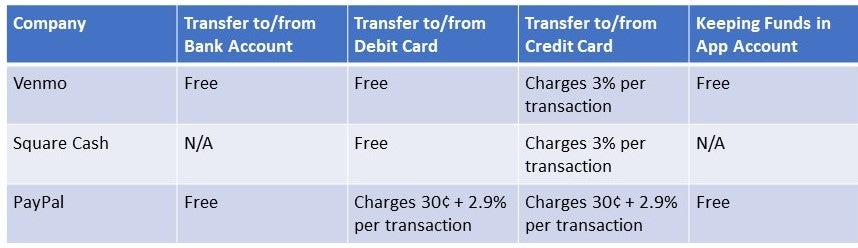

Downloading and signing up for these peer-to-peer payment apps are free. But, depending on the company, each has their own policy on which types of transfers are free, and which types of transfers will be charged. Please see the description and/or comparison table below for fee information about peer-to-peer payment apps. Additionally, please note that company policies are subject to change and should be confirmed directly with the provider.

Venmo: transfers to/from a bank account, a debit card, or keeping funds in the app account are free, whereas transfers to/from a credit card have a charge of 3% per transaction.

Square Cash: cannot transfer from a bank account or keep funds in an app account, transfers to/from a credit card have a charge of 3% per transaction, but transfers to/from a debit card are free.

PayPal: transfers to/from a bank account and keeping funds in the app account are free, whereas transfers to/from a debit or credit card both result in charges of 30¢ + 2.9% per transaction.

All the apps keep track of the transfers or requests that you or your friends make and acts as a confirmation or receipt of the transaction.

Typical examples of how students at Georgetown use these peer-to-peer payment apps include:

- Restaurant Bills

- Taxi, Uber, Lyft and Via Rides

- Utilities and Home Supplies

Budgeting & Financial Tools

Initial Expenses

In addition to bringing the documentation shown to support your immigration document, we recommend that you have access to at least $5,000 in a bank account and $500 in cash upon arrival. This money will cover initial expenses such as transportation, meals, temporary lodging, textbooks, supplies, and cell phone costs. You may also need funds for initial rent payments (often the first month, last month and security deposit), and housing supplies.

We strongly advise against carrying large amounts of cash and $100 bills can be difficult to cash in stores and restaurants. Foreign currency can be exchanged immediately at any of the airports in the Washington area and at most large banks. Banks in the area charge service fees for cashing foreign checks and you may encounter a series of fees for using your credit/debit card to withdraw cash from ATM’s. You may also want to plan ahead and check if your bank at home provides currency exchange services so that you may have US currency with you when you depart for the United States.

Please reference our Banking Information Handout (PDF) for more information.

Tuition Payment

Tuition payment is due by the date listed on the eStatement and the Office of Billing & Payments website where useful information about payment options such as Payment Plans, and billing policies can be found.

International wire payments can be made through Flywire. Follow the prompts there to obtain instructions on how to execute the transfer. You must follow the instructions and complete the transaction with your financial institution for the payment to be properly sent and credited to your account. You will be able to review the status of your payment via the Flywire site. Payments of this sort will be posted to the student’s account 2 business days after being noted as “Delivered” by Flywire.

International students and their benefactors with foreign bank accounts denominated in US dollars should note that a traditional wire payment is likely the least costly method.

Living Expenses

Students and scholars living off campus should budget carefully for their room and board expenses. Additional funds should set aside to pay for health insurance, medical costs, textbooks, and travel. Bringing dependents incurs additional expenses. Student and scholar budgets will vary according to lifestyle.

Housing costs will constitute the largest portion of your living expenses. A wide variety of housing options are available throughout the metropolitan Washington, DC area. Personal preference is generally the deciding factor in choosing a place to live. No matter what you decide, there are tradeoffs. If cost is a key issue, remember that housing is generally cheaper the farther away from the center of Washington and Georgetown you choose to live.

One method to save costs in housing is to live in a group home with other people. While this is not preferable for everyone, it is a popular choice for many students and young scholars. It saves money and increases the amount of disposable funds that can be used for other activities.

If coming to Georgetown with a spouse or family, it is advisable to find housing that best fits your family needs. You may wish to consider the reputation of public schools, access to public transportation, health care or babysitting services. It is usually not advisable to live in a group home, as many living in these housing accommodations in the metropolitan Washington, DC area are students and single, young professionals.

If you will be relying on public transportation, please factor in that living outside of Washington and commuting into Georgetown from Maryland or Virginia may require more travel time and can be expensive depending on the distance from campus. If you plan on owning a car, you should also consider that parking near campus and in the DC area is a challenge. Street parking is scarce and has time limits, and parking garages often cost at least $15 per day.

Please see below in Housing Prices to receive a better idea of what housing prices are like in the Washington, DC area.

For more information about housing and finding accommodations, please visit our office’s webpage on Off-Campus Housing. For undergraduate international students living on campus, please visit the Office of Residential Living website.

Housing Prices

While costs vary greatly depending on the type of housing, the location, the number of rooms, the amenities provided, and your own preferences, below are approximate costs for housing in the DC, Maryland and Virginia (DMV) area:

- Studio Apartment: $1,000-$2,500

- 1 Bedroom Apartment: $1,200-$3,000

- 2 Bedroom Apartment/House: $1,800-$4,500

- 3 Bedroom Apartment/House: $2,400-$6,000

- 1 Bedroom in Shared Apartment/House: $800-$1,500

For more information about off-campus housing, please visit our office’s webpage on Off-Campus Housing. For undergraduate international students living on campus, please visit the Office of Residential Living website.

Private Educational Loans

International students may wish to consider private education loans to meet college expenses. You may be required by the lender to get a credit worthy co-signer who is a U.S. citizen or eligible non-citizen.

Monthly Utility Bills

- Electricity and Gas

- Water

- Cable

- Internet

- Phone (Cell and/or Landline) Minutes

- Data

- Online Video Streaming Providers

- Amazon Prime

- Grocery delivery

Bringing Down Costs

While living in Washington, DC and the surrounding areas can be very expensive, there are many ways to moderate the high cost of living in the nation’s capital.

- Live with one or more roommates to bring down housing and utility costs

- Socialize with friends and colleagues at home, instead of meeting out for drinks or dinner. Organize a potluck in which everyone brings food and drink to share.

- Ask about student discounts for metro, restaurants and businesses in the area

- Understand how your health insurance plan works and primarily use doctors who are listed in your health plan as “in network”

- Limit Uber and Taxi

- Explore the wide variety of free activities in the Washington, DC area.