Form 8843 Filing Instructions

Below are instructions to fill out and submit Form 8843 and supporting documents to the U.S. Internal Revenue Service (IRS).

Any spouses and dependents in F-2 or J-2 status must also file Form 8843.

If you are not filing Form 8843 for the current tax year, year-specific question items will need to be adjusted.

Steps to File

1. Download Form 8843

You can download the current Form 8843 from the IRS website. This is the form every nonresident for tax purposes in F or J status must file.

Previous year forms can be found at the IRS Form 8843 Prior Year Products page.

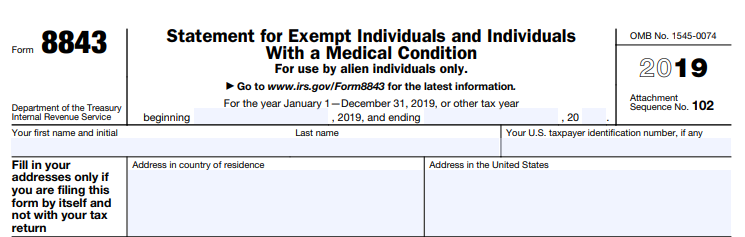

The full name of Form 8843 is “Statement for Exempt Individuals and Individuals with a Medical Condition”.

While the name may not make sense at first, if you are a:

- Student (or their spouse/dependent) who has been in F or J status for 5 or less calendar years, or

- Scholar (or their spouse/dependent) who has been in J status for 2 or less years out of the prior 6 calendar years,

then you are considered an exempt individual because you qualify as a nonresident for tax purposes without having to meet the IRS Substantial Presence Test.

2. Instructions on How to Complete Form 8843

Top Part

Below are some tips for filling out the top part of Form 8843:

U.S. Taxpayer ID Number: Your SSN or ITIN. If you do not have a SSN or ITIN, leave blank.

Address in Country of Residence: Your home country address.

Part I: General Information

Below are some tips for filling out Part I:

1a: Your visa type (F-1, F-2, J-1, J-2) and first date of entry in the United States using that visa.

1b: Your current immigration status (F-1, F-2, J-1, J-2). This usually is the same as 1a, but if your immigration status has changed since entering the United States, also enter the date of approval of your change of status.

4a: Count and write all the days you were in the United States.

4b. Count and write all the days you were in the United States in F or J status.

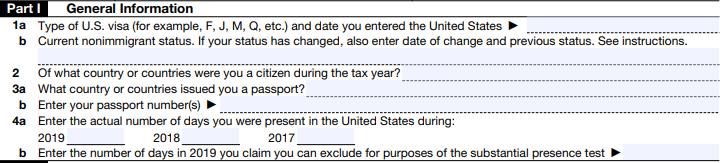

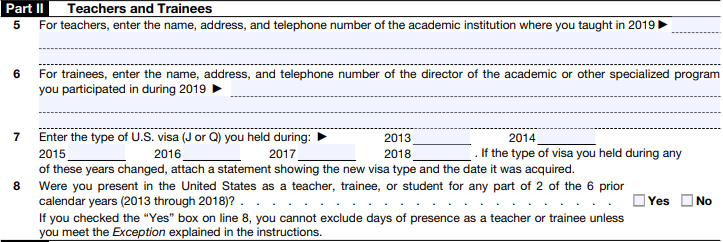

Part II: Teachers and Trainees

If you are a student (or their spouse/dependent) in F or J status, leave this section blank.

If you are a scholar, visiting professor, researcher or intern (or their spouse/dependent) in J status, continue reading.

Below are some tips for filling out Part II:

5: If you were a visiting professor, write down the below information. If you were a researcher or intern, leave blank.

- Georgetown University, 37th and O Streets NW, Washington, DC 20057, Tel: (202) 687-0100

6: If you were a researcher or intern, write down the below information. If you were a visiting professor, leave blank.

- Vivian Yamoah, Office of Global Services, Georgetown University, 37th and O Streets NW, Washington, DC 20057, Tel: (202) 687-5867

7: Enter “J” for any years you held J immigration status. Otherwise, leave blank if you were not in the United States or held a different immigration status that year.

8: If you were in J status for 2 or more years in the mentioned time period, check “Yes”. Otherwise, check “No”.

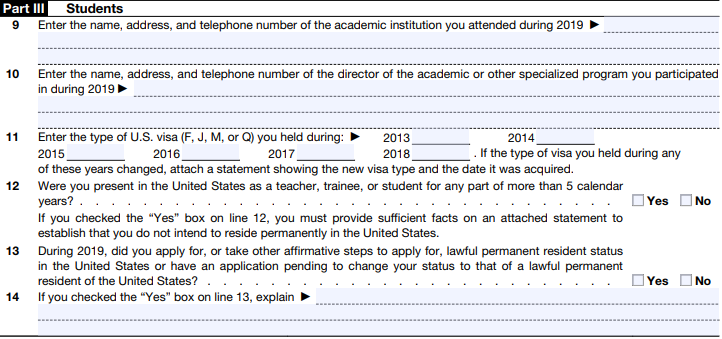

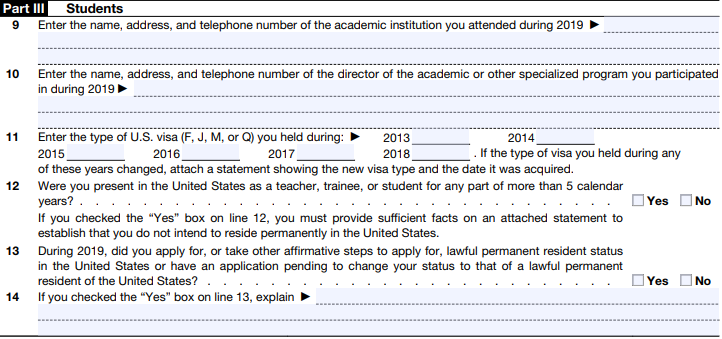

Part III: Students

If you are a scholar, visiting professor, researcher or intern (or their spouse/dependent) in J status, leave this section blank.

If you are a student (or their spouse/dependent) in F or J status, continue reading.

Below are some tips for filling out Part III:

9: Write in:

- Georgetown University, 37th and O Streets NW, Washington, DC 20057, Tel: (202) 687-0100″

10: Write in:

- Vivian Yamoah, Office of Global Services, Georgetown University, 37th and O Streets NW, Washington, DC 20057, Tel: (202) 687-5867″

11: Enter “F” or “J” for any years you held F or J immigration status. Otherwise, leave blank if you were not in the United States or held a different immigration status other than “F” or “J” that year.

12: If you have been in F or J status for more than 5 calendar years, check “Yes”. Otherwise, check “No”.

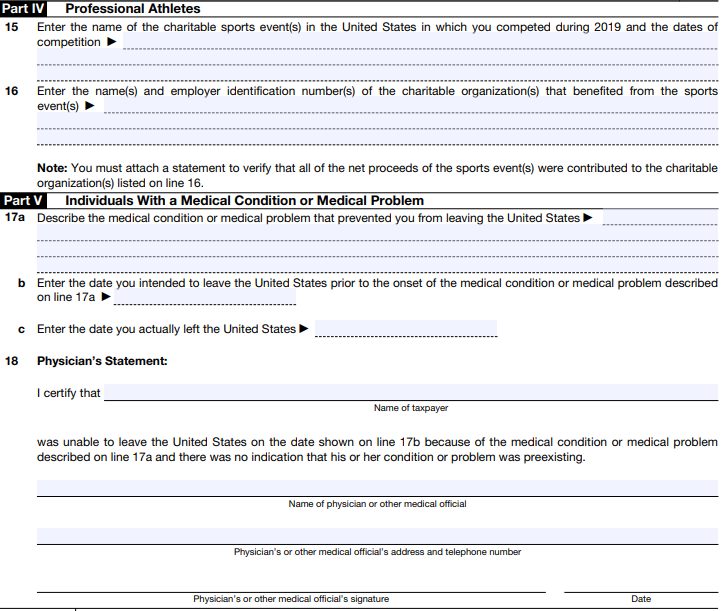

Part IV and V: Professional Athletes and Individuals with a Medical Condition

Leave Part IV and V blank.

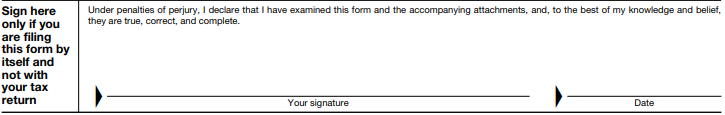

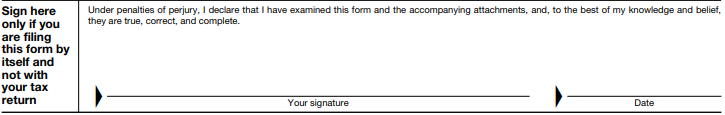

Sign and Date

Sign your name and date to complete filling out Form 8843.

3. Assemble and Mail Form 8843

Collect Supporting Documents

Attach the following documents to your completed and signed Form 8843:

- Copy of Form I-20/DS-2019

- Copy of Passport Information Page

- Copy of Visa

- Most Recent I-94 Record

Mail Form 8843 and Supporting Documents

Mail Form 8843 and supporting documents in an envelope to the following address:

Department of the Treasury

Internal Revenue Service Center

Austin, TX 73301-0215

Current Form 8843 and supporting documents must be mailed by June 15th. They do not need to be received by that date.

Submission of prior year Forms 8843 and supporting documents should be mailed to the IRS as soon as possible.

4. Repeat Steps 1-3 for All F and J Spouses/Dependents

All spouses and dependents in F-2 or J-2 must send their own Form 8843 and supporting documents as a separate submission (different envelope) to the IRS.

Special Instructions for F and J Student Spouses and Dependents

Form 8843 should be completed the same, except for the following sections:

9: Write in:

- Spouse/Dependent of student attending Georgetown University, 37th and O Streets NW, Washington, DC 20057, Tel: (202) 687-0100

10: Write in:

- Spouse/Dependent of student attending Georgetown University whose Program Director is Vivian Yamoah, Office of Global Services

Special Instructions for J Scholar Spouses and Dependents

Form 8843 should be completed the same, except for the following sections:

5: If you are a spouse or dependent of a visiting professor, write down the below information. If you are the spouse or dependent a researcher or intern, leave blank.

- Spouse/Dependent of visiting professor teaching at Georgetown University, 37th and O Streets NW, Washington, DC 20057, Tel: (202) 687-0100

6: If you are a spouse or dependent of a researcher or intern, write down the below information. If you are a spouse or dependent of a visiting professor, leave blank.

- Spouse/Dependent of researcher/intern whose Program Director is Vivian Yamoah, Office of Global Services, participating at Georgetown University, 37th and O Streets NW, Washington, DC 20057, Tel: (202) 687-5867

Dependents Under the Age of 18

If a dependent is too young to sign his or her Form 8843, a parent or guardian can write the dependent’s name in the space provided at the bottom of Form 8843.

The parent or guardian should add:

- “By (signature), parent (or guardian) for minor child.”

J-2 Spouses or Dependents with Income

J-2 spouses or dependents who made income should refer to the OGS Tax Filing Instructions page to prepare their federal and state tax returns.

If your spouse or dependent needs to request a Sprintax promo code, please contact internationalservices@georgetown.edu.

Additional Resources

- Sprintax Article “Form 8843 – What is it and How do I File it?”

- Tax FAQs Page